Thinking of Moving Up? Do It Now!

New reports are revealing that the number of existing home owners purchasing a house is beginning to increase. Some are moving up, some are downsizing and others are making a lateral move. Another study shows that over 75% of these buyers will, in fact, be in that first category: a move-up buyer.

There is no way for us to predict the future but we can look at what happened over the last year. Let’s look at buyers that considered moving up last year but decided to wait instead.

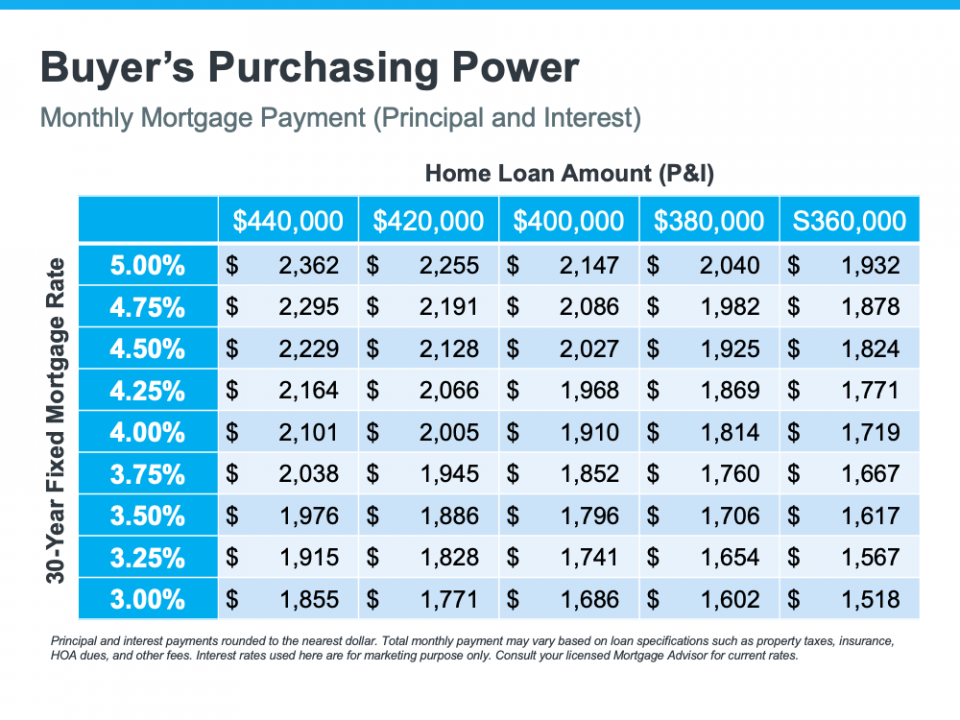

Assume they had a home worth $300,000 and were looking at a home for $400,000 (putting 10% down they would get a mortgage of $360,000). By waiting, their house appreciated by 12% over the last year (national average based on the Case Shiller Pricing Index). Their home would now be worth $336,000. But, the $400,000 home would now be worth $448,000 (requiring a mortgage of $403,200).

Here is a table showing what additional monthly cost would be incurred by waiting:

If your family sees yourself in this situation, it may make sense to move now than later. Prices are definitely appreciating and interest rates are beginning to rise.

Let’s get together to discuss your options. 631-774-2528

If you know someone who would appreciate the level of service and expertise that I provide, please contact me and I’ll be happy to follow up and take great care of them.